Rosneft and BP Form Global and Arctic Strategic alliance

BP and Rosneft announced today that they have agreed a groundbreaking strategic global alliance.

BP and Rosneft announced today that they have agreed a groundbreaking strategic global alliance.

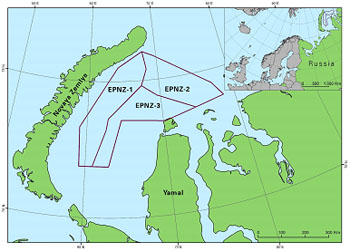

Rosneft and BP have agreed to explore and develop three license blocks - EPNZ 1, 2, 3 – on the Russian Arctic continental shelf. These licences were awarded to Rosneft in 2010 and cover approximately 125,000 square kilometres in a highly prospective area of the South Kara Sea. This is an area roughly equivalent in size and prospectivity to the UK North Sea.

This historic agreement creates the first major equity-linked partnership between a national and international oil company. Following completion of this agreement, Rosneft will hold 5 per cent of BP’s ordinary voting shares in exchange for approximately 9.5 per cent of Rosneft’s shares. The share swap component of the alliance creates strategic alignment to pursue joint projects and demonstrates mutual confidence in the growth potential of both companies.

BP and Rosneft have also agreed to establish an Arctic technology centre in Russia which will work with leading Russian and international research institutes, design bureaus and universities to develop technologies and engineering practices for the safe extraction of hydrocarbon resources from the Arctic shelf. The technology centre will build on BP’s deep offshore experience and learnings with full emphasis on safety, environmental integrity and emergency spill response capability.

Rosneft and BP have agreed to continue their joint technical studies in the Russian Arctic to assess hydrocarbon prospectivity in areas beyond the Kara Sea. The parties will also seek additional opportunities for international collaboration beyond their 50/50 joint venture partnership in Ruhr Oel GmbH, a refining joint venture in Germany (subject to completion of Rosneft’s recent purchase of 50 per cent of Ruhr Oel from PDVSA).

Igor Sechin, Deputy Prime Minister of the Russian Federation, who participated in the signing ceremony, said: “Global capital and Russian companies are clearly ready to invest in world class projects in Russia; and Russian companies are quickly emerging at the forefront of the global energy industry.”

Energy Secretary Chris Huhne said: «The British government welcomes this strategic global partnership between BP and Rosneft. It is a groundbreaking deal between 2 of the largest oil companies. Russia is centrally important to global energy with nearly 20% of the daily gas production and about 13% of today's oil production. This initiative, to explore and develop the new sources of oil and gas is good news for Europe, for the UK, energy security and worldwide. As we move overtime Russia's oil and gas will play a major role in fueling the world and a key role for Europe».

BP’s chief executive, Bob Dudley, said: “This unique agreement underlines our long-term, strategic and deepening links with the world’s largest hydrocarbon-producing nation. We are very pleased to be joining Russia’s leading oil company to jointly explore some of the most promising parts of the Russian Arctic, one of the world’s last remaining unexplored basins. Underpinning this alliance is a new type of relationship based on a significant cross-shareholding, and bringing together technology, exploration and safe and responsible field development skills. We are very pleased to welcome Rosneft as a strategic partner and major shareholder in the BP Group.”

Rosneft’s President, Eduard Khudaynatov, said: “I am pleased that in just a few months we’ve significantly moved forward in implementing Russia’s offshore strategy. In its operations, our future joint venture will utilize the experience and expertise of BP, one of the leaders in the global oil and gas industry. This project is unique in its complexity and scale both for Russia and the global oil and gas industry. We see it as the next step in developing our relations with BP.”

BP Chairman, Carl-Henric Svanberg, said: “The world’s need for energy continues to increase. BP is working with national oil companies using its leading exploration skills and expertise to meet this demand. This is a trend which will increase as access to resource becomes scarcer.

This landmark deal creates a deep partnership which represents a new stage in these relationships. The exchange of shares demonstrates our mutual commitment. The BP board believes that the combination of assets and skills will unlock significant value and thus the issue of shares to Rosneft is in the interests of all shareholders.”

The aggregate value of the shares in BP to be issued to Rosneft is approximately $7.8bn (as at close of trading in London on 14 January 2011). The transaction is subject to certain listing approvals and the completion of certain administrative requirements and is expected to complete within a few weeks. BP and Rosneft view their cross-shareholdings as long term and strategic.

Rosneft is Russia’s leading oil producing company. It produces some 2.4 million barrels of oil equivalent (boe), and has reserves of 15,146 billion boe. It produces oil in all key regions of Russia. Rosneft reported (pre tax) profits for the year end 31 December 2009 of $8,519m and gross assets (as at 30 September 2010) of $87,984m.

|

Notes to editors In October 2010, Rosneft announced that it had agreed to purchase from PdVSA 50 per cent of Ruhr Oel GmbH, a German refining joint venture with BP. In January 2006, BP and Rosneft launched a scientific research study to evaluate the Russian Arctic. In 1998, BP and Rosneft started an alliance that eventually led to the formation of three joint ventures to conduct exploration on the Russian continental shelf, offshore Sakhalin. The reserve figures quoted above have been estimated by Rosneft on an SEC (life of field) basis. The swap ratio is based upon the volume weighted average prices of the shares of the two companies across all exchanges in which significant numbers of shares of the companies, (and associated American Depositary Receipts and Global Depositary Receipts), are traded (Moscow, London, New York) over the fifteen trading days in which all three exchanges were open, beginning 9th December, 2010 and ending 12th January 2011. BP has agreed to issue 988,694,683 ordinary shares to Rosneft; Rosneft has agreed to transfer 1,010,158,003 ordinary shares to BP. The shareholdings being exchanged are subject to mutual lock-up restrictions for a period of two years (subject to limited exceptions). After the lock-up period, the exchanged shareholdings of BP and Rosneft will be subject to certain disposal restrictions. |

|

| Map : Location and scale of South Kara Sea licences |

Cautionary statement

This release contains forward-looking statements including with respect to the potential to develop new hydrocarbon resources and other statements which are generally, but not always, identified by the use of words such as ‘will’, ‘is expected to’, ‘plans’, and similar expressions. Forward-looking statements involve risks and uncertainties because they depend on circumstances, that will or may occur in the future. Actual results may differ depending on a variety of factors, including developments in technology, regulatory actions, economic conditions, oil and gas prices and other factors discussed in this release and in our quarterly stock exchange announcements.

Lambert Energy Advisory Limited acted as sole adviser to BP on this transaction.

For further information:

Rosneft Press Office: +7 985 186 0642

BP Press Office London: +44 20 7496 4076

BP Press Office Moscow: +7495 363 6262